Bitcoin may be the market leader, but it doesn’t always stay in the spotlight. When BTC dominance drops to 60% as it shows right now, it signals more than just a technical shift. It often marks the beginning of capital rotation, increased risk appetite, and the emergence of higher-beta plays across the crypto landscape.

As of two months ago, BTC dominance has fallen almost 15%, a sharp drawdown since the start of 2025. While some interpret this as a bearish signal for Bitcoin, veteran traders know: when Bitcoin steps back, altcoins step up.

But not all altseasons are created equal.

In this piece, we examine the three key mechanisms that consistently follow BTC dominance downturns: sector rotation, ecosystem narratives, and volatility clustering. These drivers shape where capital flows, how it behaves, and where the next asymmetrical opportunities lie.

1. Capital Rotation: Follow the Flow, Not the Hype

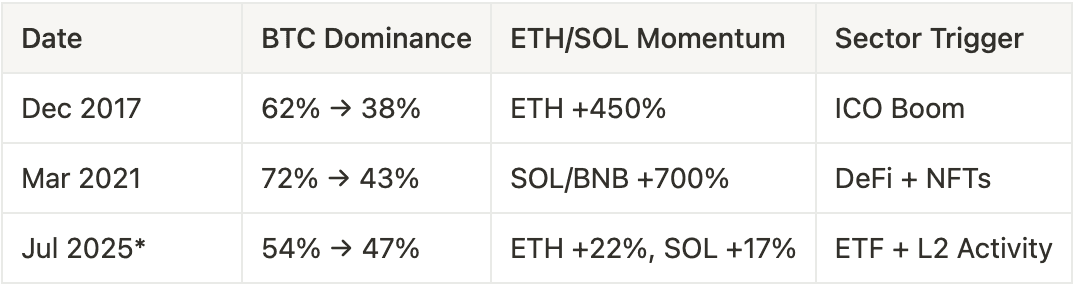

Historically, sharp drops in BTC dominance have been followed by explosive rallies in alternative sectors but timing and allocation matter. Capital rotation doesn’t happen all at once; it follows patterns that reward early positioning.

Here’s how the typical flow progresses:

Phase 1: BTC leads the rally, pulling in institutional and macro-driven money.

Phase 2: ETH and L1 majors absorb overflow as capital seeks scale and yield.

Phase 3: Risk rotates into L2s, DeFi, and high-volatility narratives like meme coins or gaming.

We’re currently in Phase 2. Ethereum inflows are at multi-month highs, boosted by ETF approval tailwinds and a surge in restaking adoption. Solana has broken out on multiple DeFi pairs, Avalanche is gaining traction in RWAs, and Base’s ecosystem is seeing its highest daily active users since launch.

Strategic Insight: Altseason isn’t a calendar event, it’s a capital migration. Understanding where capital wants to go is more important than where it was.

2. Narrative Fracture: From One Story to Many

When BTC dominance wanes, market narratives diversify.

Bitcoin represents the macro signal. It’s what gets airtime on Bloomberg and CNBC. But when dominance drops, the spotlight fragments opening the door for protocol-specific narratives to take over.

Here’s what we’re seeing now:

ETH: Boosted by ETF anticipation and treasury accumulation for companies like SBET.

SOL: Positioning itself as the performance chain for memecoins and high-speed trading.

L2s: Arbitrum, Base, and Blast seeing surges in TVL and developer activity.

AI + RWA tokens: Riding macro-tech tailwinds and institutional onboarding.

This narrative decentralization leads to higher dispersion, where winners vastly outperform the average, but also where losers drop hard. It’s no longer about holding “altcoins” as a category. It’s about knowing which altcoins are riding real structural momentum.

Strategic Insight: When BTC dominance falls, alpha shifts from passive holding to active selection. Indexing works less; research works more.

3. Volatility Clustering: Altseasons Are Never Smooth

Let’s be clear: altcoin seasons are rarely straight lines.

They’re chaotic, often marked by liquidity surges, flash pumps, and high-frequency mean reversion. Why? Because many altcoin markets are shallower, less mature, and have fragmented liquidity , making them extremely sensitive to small capital inflows.

During dominance drops, we tend to see:

Increased volatility correlation across alt pairs

Sharp spikes in slippage during breakout volume

Microstructure gaps, especially on Tier 2/3 exchanges

In July 2025 alone, over $1.1B in liquidations came from altcoin perpetuals — the highest monthly total since October 2022. Spreads on DEXs have widened, while gas fees on L2s have spiked 3x, signaling intense capital migration and trade routing pressure.

Strategic Insight: Altseason profits don’t come from conviction alone. They come from execution under pressure.

Conclusion: Don’t Just Watch BTC, Read the Rotation

BTC dominance is more than a chart metric, it’s a market compass. A falling dominance rate doesn’t mean Bitcoin is weak; it means the market is expanding.

Altseasons are moments when attention, liquidity, and narrative power splinter outward. We’re entering that phase now. But riding it effectively means knowing which narratives are sticky, which flows are sustainable, and which names are just noise.

Bottom Line:

BTC dominance falling is your early warning signal.

Altcoins don’t follow, they compete. And some of them win big.

It’s crucial to understand where it’s breaking.